A Love Letter to House Insurance – That Expletive High Maintenance Affair!

Ah, house insurance. The kind of fiery, passionate love-hate relationship where you can’t survive without ‘em, yet, at every turn, they seem hellbent on making you wish you never met. It’s like paying crazy cash every month to keep a pet crocodile—totally bizarre!

Let me give you a brief and lovable tour of my cozy relationship with my oh-so-generous house insurance company. Strap in tight…this tale’s got some wild turns.

After being held at price point gunpoint, I decided to shell out a cool $238 every month to keep my house insured. Now, if you ask me, that’s no chump change, and at times had me contemplating whether buying a steel bunker instead of a “normal” home would’ve been a better option. But hey, who am I to predict tornadoes, stray trees, and the occasional vindictive squirrel?

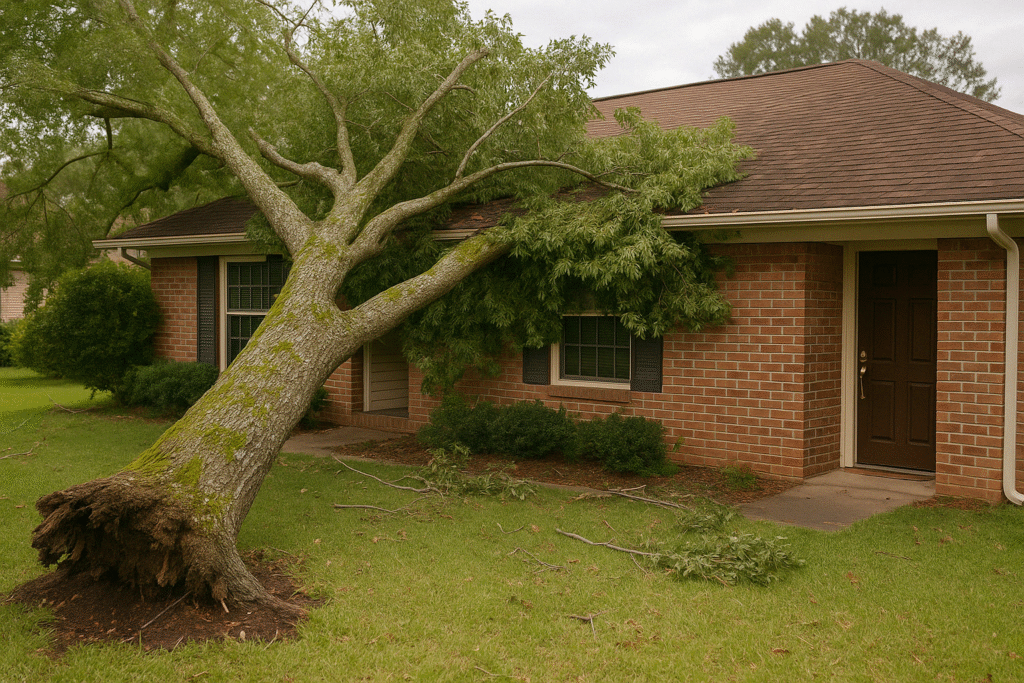

Speaking of rogue trees, I recently had an arboreal visitor who took up a rather inconvenient new home on my roof. Well—perched is the better word. The tree didn’t so much destroy my house as dramatically sprawl itself across the front lawn, lightly draped over my roof like it was trying to hug me into debt. Luckily, the damage was minor, but you’d think I had submitted a claim for a full-blown demolition job with how it all played out.

So, of course, I turned to the comfort and warmth of my insurance company for comfort and aid.

Oh, how my expectations were shattered…

After numerous pleas, begging, and perhaps a tear or two shed on my part, the tree was finally gone. And hey, they were kind enough to send me a payout for repairs… minus my meager $3,000 deductible. You read that right. A $3,000 deductible! My response? Probably a mix of incredulous laughter and disbelieving anger.

That’s right, folks. I was paying $238 per month, and once disaster hit, I had a whopping $3,000 to shell out before any aid kicked in. My roof might as well have a permanent sign that reads, “Open Hospitality for Roaming Trees and Temporarily Unemployed Bird Flocks.”

But wait, the fun didn’t end there. As a crude little cherry on top, my latest bill now amounts to $338.63 a month. You could almost hear them gleefully cackling, “You thought $238 was pricey? Hold my beer!”

Yes, you read that correctly. They ramped up my monthly insurance by $100 after my claim. So now I’m looking at over $4,000 per year to keep my house “safe,” allocating another couple thousand to a deductible kitty, and keeping my digits crossed that another sacrificial tree doesn’t find its way to my roof.

In my humble, entirely reasonable opinion, this is absolutely and unequivocally, INSANE! Yes, my love for caps is directly proportional to my loathing for these shenanigans.

So let me end this tirade by exclaiming from the deepest depths of my homeowner’s heart:

House Insurance, you’re a must-have… but totally bullshit.

💥 Got a horror story of your own?

Drop it in the comments. Let’s build a support group for the emotionally (and financially) scarred victims of house insurance. Misery loves company—and we’ve got premium rants to share.

Written By:

William Thomas

This isn’t rage—it’s truth with the volume turned up.

☕ Drop a coffee in the tip jar — because sarcasm and hosting fees don’t pay themselves.

👉 Buy Me a Coffee

🛒 Grab official Spill By Bill merch — where sarcasm gets screen printed.

👉 Visit the Shop